Every judgment against a person, or lien against a property, is issued a docket number by a court of law. Understanding these docket numbers will help you resolve a specific type of judgment or lien. Municipal Court Code Enforcement (CE) or Statement of Claim (SC) docket numbers contain a two-digit “Code” in the 5th and 6th digits of the judgment number. Use this Code to know:

- The type of judgment/lien that exists

- What City agency or department to contact for your payoff request.

Only Municipal Court Code Enforcement judgments contain a two digit code in the docket number.

When submitting a payoff request, you must provide the entire docket number. Below, please find information about how to read a CE docket number, and a list of who to contact based on the two-digit Code.

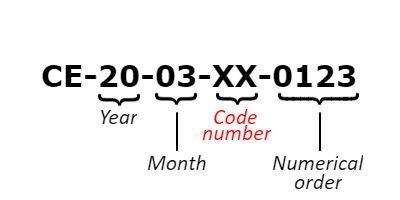

Parts of a Municipal Court Code Enforcement docket number

Municipal Court Code Enforcement (CE) and Statement of Claim (SC) docket numbers filed by the City’s Law Department Tax Unit start with the letters CE or SC.

The first set of two digits represents the year of filing. The second set of two digits represents the month of filing. The third set of two digits represents the two-digit Code number that is tied to the type of case filed by the City. The fourth, and last, set of digits are assigned in numerical order of filing by the Municipal Court.

For example, in the docket number CE-20-03-XX-0123:

- 20 represents the year 2020

- 03 represents the month of March

- XX represents the Code number

- 0123 is the numerical order assigned by the court.

Match judgment/lien numbers to City agencies

You can use the table below to match the Code number found in a Municipal Court CE or SC docket number to the City agency or department that will provide payoff to resolve the judgment. This table also provides contact information to resolve Court of Common Pleas (“CCP”) liens/judgments and other Municipal liens.

For properties with Real Estate Tax delinquency, every individual tax year has a 15-digit lien number containing the capital letter “R” in the middle. For more information about Real Estate Tax lien numbers, see our Real Estate Tax balance website.

| Court or type of Municipal judgment or lien | Judgment or lien covers | Send request to: | Instructions |

|---|---|---|---|

| CE Code 60, 73, 74, 75,76, 77 and CCP self-assessed Tax Liens | Business taxes and Use & Occupancy CODE 74 | Request a payoff | Use our online form. Be prepared to provide:

|

| CE Code 70 | Business taxes | Launch Revenuecollections.com and select Contact Us or send email to info@rcbtax.com | These payoff requests are processed by the Revenue Collection Bureau (RCB) |

| SC Code 71 and CCP actions containing “T” in the docket. | Real Estate Tax and general Sheriff Sale info | Nataly.Espada@phila.gov | Please include all three addresses when sending an email to ensure a response. |

| SC Code 81 | Real Estate Tax | Call (215) 735-1910 | These payoff requests are processed by Goehring, Rutter & Boehm (GRB) |

| Delinquent Real Estate tax accounts served by Linebarger Goggan Blair & Sampson | Real Estate Tax | Call (215) 790-1117 or (866) 209-2747 | These payoff requests are processed by Linebarger Goggan Blair & Sampson (LBR) |

| CE Code 72 and CCP “LN” or “W” liens | Water | wateramountdue@phila.gov | Send all water payoff requests using the Water Payoff form (please request form if needed). This form must be prepared in Adobe PDF format (do not handwrite) and sent via email. |

| CE Code 82 | Water revenue | Launch Revenuecollections.com and select Contact Us or send email to info@rcbtax.com | These payoff requests are processed by the Revenue Collection Bureau (RCB) |

| CE Code 32 or 36 |

|

LawCodeEnforce@phila.gov | In the subject line of the payoff email include the full docket number along with the defendant’s name. The email must also include the property address(es) covered by the violation, the relationship to the named defendant, and a contact mailing address and email address. For questions, call (215) 683-5110. |

| CE Code 33 | Office of Administrative Review: Code Unit | Email PhilaCodeUnit.Settlement@trellint.com or fax (215) 686-1578. | Please allow at least 7 to 10 business days for the payoff. Questions, call: (215) 686-1587. |

| SCE Municipal liens (do not have a Code number) | Refuse (trash) fees | SolidResources@phila.gov or fax (215) 686-6533. You may also visit the office in person: 1401 John F. Kennedy Blvd. Concourse Level Refuse Collection Unit | All other questions must be sent by email to SolidResources@phila.gov. For questions, please call (215) 686-5090 |

| Agency Receivable lien (do not have a Code number) | Nuisance Liens or Agency | revenue@phila.gov | For questions, please call (215) 686-6648 or (215) 686-2670. |

Other kinds of judgments or liens

| Lien or judgment type | Judgment / lien covers | Send request to: | Instructions |

|---|---|---|---|

| PGW CCP liens | Gas | Please send an email to: michael.williams@pgworks.com and pamela.thompson@pgworks.com. | OR, fax your requests to (215) 398-3350 or (215) 684-6150, or call (215) 978-1053. |

| CCP Traffic Court judgments | Please fax your request to (215) 686-1628 using company letterhead. | You must include the Defendant’s date of birth and full SSN and list any/all traffic court judgments docket numbers. For questions, please call (215) 686-1627. | |

| Criminal Court Cost and Fine, Fees &/or Restitution Judgments filed by Commonwealth of Pennsylvania C/O 1st Judicial District of PA APPD/OJR/OCC (Previously filed under the following: Clerk of Quarter Sessions; Clerk of Court; Probation Department) |

Please email payoff request to James.Jordan@courts.phila.gov. |

You must include the Judgment number, the Defendant’s date of birth and the last 4 digits of the Defendant’s SSN. |