Tax season is here, both for taxpayers and lawmakers. By Tuesday, April 15th, most Philadelphians will be required to file their taxes. For low-income households, tax season is an important opportunity to claim money available to you.

Unfortunately, every year many eligible households miss out on tax credits designed to fight poverty. While Philadelphians are gathering W-2’s or exploring the IRS’s new 100% free DirectFile system, Congress is in budget negotiations over the tax code. These debates will determine whether the expanded Child Tax Credit (CTC) expires at the end of this year, and what policies will benefit low- and middle-income families.

Last month, Mayor Parker called on Washington DC to extend the Child Tax Credit, and Philadelphia Councilmember Rue Landau introduced Resolution No. 25008000 calling on Washington to do the same. Council adopted it on February 13, 2025, reflecting broad agreement that these credits are vital for our city’s families.

The Office of Community Empowerment and Opportunity is leading a community effort with partners across the city to make sure that every Philadelphian uses the “Claim Your Money” services in their neighborhood and in their preferred language. Learn how to connect to Claim Your Money and multilingual resources.

Addressing persistent poverty in Philadelphia

While Philadelphia’s poverty rate has been gradually declining—from 28.4% in 2011 to 20.3% in 2023—it’s still the highest among the nation’s ten most populous cities. Federal tax credits like the Earned Income Tax Credit (EITC) and CTC are crucial for putting cash into the pockets of low- and moderate-income families. They alleviate poverty, incentivize work, and offset the cost of raising children, leading to positive long-term effects for families and children, such as higher workforce participation and improved earnings in adulthood.

However, in Philadelphia, many households—especially those not required to file taxes due to low or no income—often miss this opportunity for financial relief. Each year, an estimated 50,000 Philadelphians miss out on claiming the CTC, leaving nearly $100 million unclaimed. This may be because they are unaware that they are eligible for the credits or that they qualify for free tax-filing systems and programs. They may also face barriers, such as not being able to afford to pay high and predatory fees charged by tax prep companies. They may also face language barriers to accessing information on the availability of these funds.

The Office of Community Empowerment and Opportunity steps in

In response to the tax credit gaps, the Office of Community Empowerment and Opportunity (CEO) has partnered with the Scattergood Behavioral Health Foundation since 2022 to award $192,000 per year in City funding to 23 local organizations to help maximize the number of Philadelphia households claiming the CTC and EITC as part of our ClaimYourMoneyPHL campaign.

The grassroots organizations capitalized on the trust and goodwill they have cultivated with the communities they serve. Through door-to-door and community events outreach, the organizations answered residents’ questions, offering culturally sensitive and bilingual services sharing information about how residents can file for the tax credits. The organizations referred community members to two organizations supported by the City of Philadelphia, Campaign for Working Families (CWF) and Ceiba, to provide free tax filing.

The CTC and EITC change the lives of Philadelphians

The grassroots organizations reached over 80,000 individuals in 2024, including at-risk mothers, immigrant communities, low-income communities and previously incarcerated individuals. The EITC and CTC provided significant financial relief, enabling residents to address basic needs, pay debts, improve housing conditions, and invest in long-term goals (e.g., homeownership). One Philadelphian assisted through the efforts of the grassroots organizations stated, “Receiving the Earned Income Tax Credit and Child Tax Credit has impacted me and my family financially. My family and I felt great and very blessed. It has put me and my family on the path to success.”

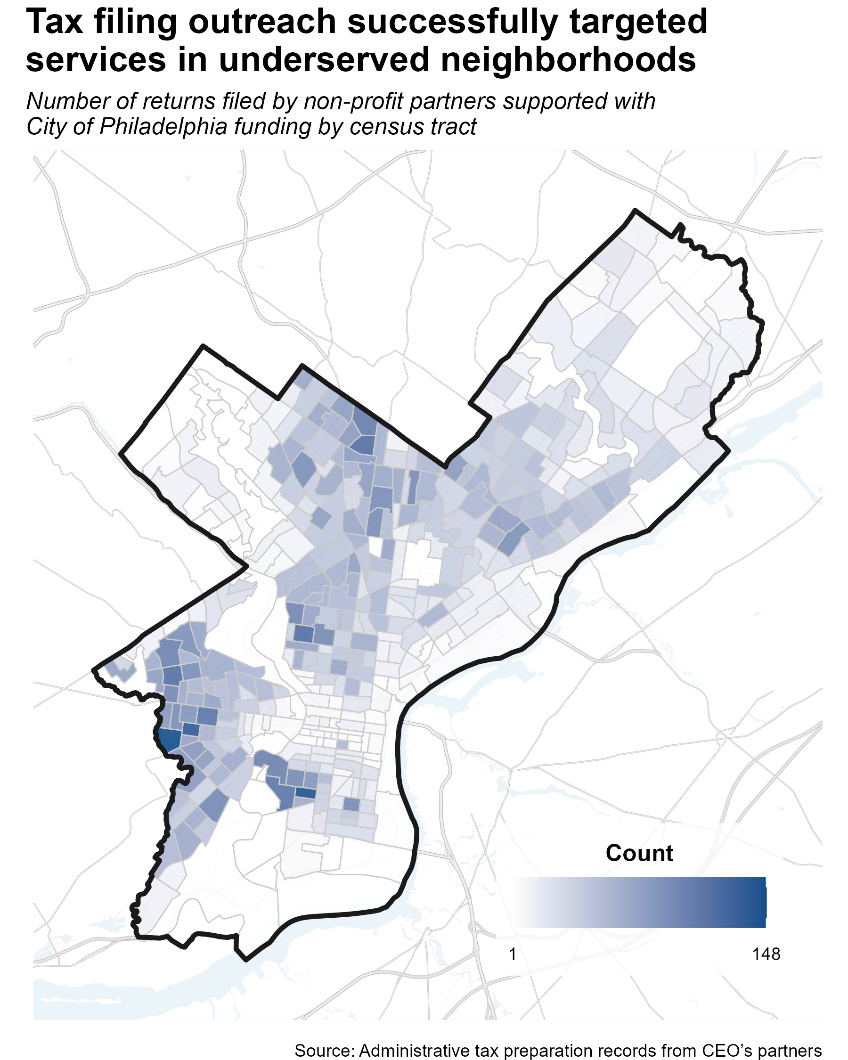

Ceiba and CWF’s tax filings were concentrated in the north, west, and southwest of the city, reflecting higher levels of economic need in those sections of the city.

In addition to neighborhood-level patterns, the success of the outreach campaign is also clear in the demographics of who filed with Ceiba and Campaign for Working families. Overall, a majority of clients were Black, however one of our partners Ceiba served 78% Hispanic clients.

The income group who filed most frequently made between $10,000 and $30,000 a year. This group also typically received the largest refund, with a median return valued at $733. Average refunds were much higher than median refunds across the board (a pattern common in financial data, especially for data like this, without negative dollar amounts), but this income band ($10,000–30,000) also had the highest average refund: $1,746.

| Annual income | Number of returns | Median refund value | Average refund value |

|---|---|---|---|

| $0–2,499 | 726 | $33 | $422 |

| $2,500–9,999 | 1,878 | $378 | $759 |

| $10,000–29,999 | 4,651 | $733 | $1,746 |

| $30,000–49,999 | 3,882 | $611 | $1,558 |

| $50,000–79,999 | 2,266 | $568 | $1,252 |

| $80,000+ | 603 | $0* | $1,192 |

*Over half this highest-income group had no refund or a net tax liability. This analysis considered only positive refund amounts, not outstanding/negative tax liabilities.

As the table above shows, tax filings within this program have a “phase-in” and “phase-out” that mirrors the current structure of the CTC and the EITC. This suggests the outreach was targeted to attract families who had the most to gain from filing their taxes.

Sustaining the Child Tax Credit and Earned Income Tax Credit

Through this campaign, CEO and its partners demonstrated that targeted, community-led efforts can financially empower low-income residents, with partners securing a total of $19.4 million in refunds. Of that amount, nearly $16 million went to households making less than $50,000 per year. The impact of these programs is a testament to what can be achieved when equity and empathy guide public policy.

Because the 2021 credit was fully refundable and had no “phase in” or exclusion provisions for low-income parents, many people with low or no income were eligible for the CTC. After this change, the year 2021 saw the lowest US child poverty rate on record in the US. While the Biden administration advocated for this policy to be permanent, Congress allowed the provision to expire after the 2021 tax year, in effect cutting nominal value of the CTC. That brings us to the pivotal point at which we are today. After 2024, CTC could shrink even further, from $2,000 back to pre-2017 non-refundable maximum of $1,000.

Given the transformative impact of CTC in the lives of low-to-moderate income people in Philadelphia it is important to spread awareness, share impact, and advance utilization of CTC and EITC across the City.