It’s that time of year again—tax season. If you’re a Philly business owner with a net operating loss, you might be wondering how to use it in future tax years to reduce your tax liability. The good news is that the City lets you carry forward business losses incurred in 2022 and after, for 20 years.

If you had a loss in 2024 and want to carry it forward, you can do it on the Philadelphia Tax Center. The site lets you document losses and carry them forward automatically, from different tax years or periods. Read on to find out more.

Loss carry forwards

Businesses in Philadelphia can use net operating losses (NOL) incurred in one tax year to offset future taxable net income.

For example, if you incurred a $100,000 loss in 2023, you could carry that loss forward to offset taxable net income in 2024. If you have a taxable net income of $50,000 in 2024, you could use the loss from 2023 to offset the 2024 taxable net income. You’ll still have $50,000 of the original loss to carry forward to offset future years’ taxable income.

Continuing the same example, if you make $75,000 in 2025, you can offset $50,000 of that taxable income with the unused loss from 2023. This reduces your taxable net income for 2025 to $25,000.

In essence, a loss carry forward lets you use today’s loss to offset future years’ taxable net income, reducing your tax liability in those years. Plus, a taxpayer’s income and losses are smoothed out when past losses are deducted from future profits. It reduces the tax gap between businesses with stable profits and ones with fluctuating profits.

Here is the same example from above in a different way:

| Year | Profit or loss for the year | How much Loss Carry Forward is left? |

|---|---|---|

| 2023 – incurred a loss | ($100,000) | ($100,000) |

| 2024 – had taxable net income | $50,000 – $50,000 = $0 taxable income | $50,000 |

| 2025 – had taxable net income | $75,000 – $50,000 = $25,000 taxable income | $0 |

Document your carry forwards

It’s important to keep a record of your loss carry forwards. The best way to do this is to file a complete Business Income & Receipts Tax (BIRT) return. Even if you don’t have a BIRT filing requirement, you should still file a complete return if you have a loss you want to carry forward. This is the best way to document your losses. It’s also the only way we can have a record of them in our system.

Get it done online

You can document, view, and carry forward losses online through the Philadelphia Tax Center. You can access the site from your phone or tablet.

To Document

To document your loss online:

- Go to tax-services.phila.gov and log in,

- Find your BIRT account and select “File, view, or amend returns”

- Choose “File now” on the “Returns” screen. Review your information and select “Next.”

- On the “Tax liability” screen, enter your liability amount and select “Next.” Again, don’t forget to file a complete BIRT return even if you’re not required to do so. Follow the on-screen directions to complete the process.

To view

Follow these steps to see your carry forward amount:

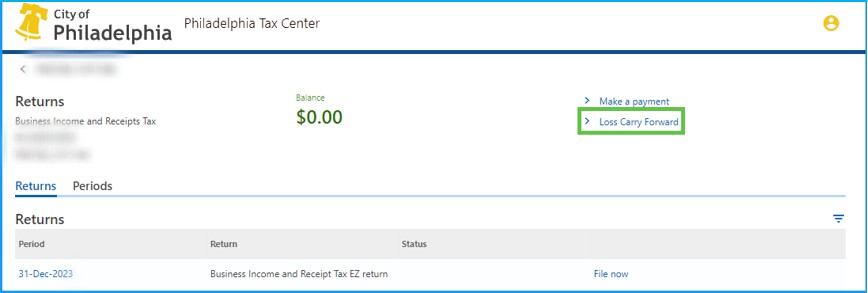

- Access your BIRT account on the Philadelphia Tax Center,

- Choose “File, view, or amend returns” in Summary View,

- Select the “Loss Carry Forward” hyperlink on the next screen. It’ll show you your carry forward amount.

The “Loss Carry Forward” link will only appear in your BIRT account if there’s a recorded loss.

Philadelphia’s Business Income & Receipts Tax (BIRT) applies to gross receipts and taxable net income for business activities conducted in the city. The current tax rate for the net income portion of BIRT is 5.81%. For help or more information, please call (215) 686-6600.