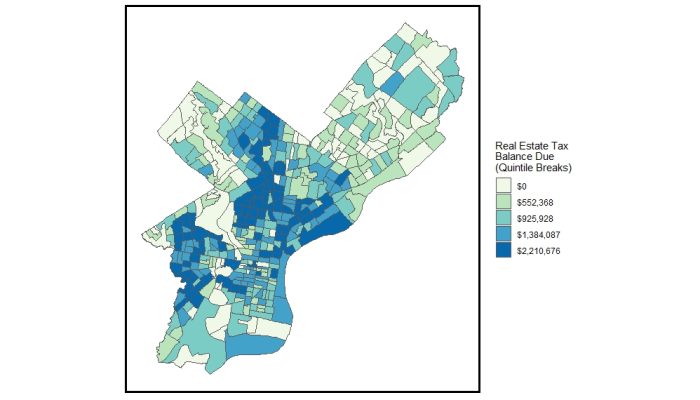

A new dataset from the Philadelphia Department of Revenue shows properties with tax delinquencies in a new, simpler format. You can access this data on OpenDataPhilly.

Delinquencies are now broken down by zip code, council district, and census tract for easy understanding. A Philly property tax account is delinquent if Real Estate Tax isn’t paid by January 1 the following year after the tax was due.

The latest open dataset includes principal due, interest, penalty, and outstanding balances. It also shows the earliest and latest delinquent accounts.

The data is aggregated at the individual level to protect taxpayers’ privacy. It can be exported into Excel spreadsheets for easy sorting, analysis, and visualization.

Researchers and urban economists looking to analyze tax delinquencies will find this data helpful.

Due to recent upgrades to Revenue’s data systems, this dataset will be routinely updated. Visit tax-services.phila.gov for more information on individual property tax accounts.