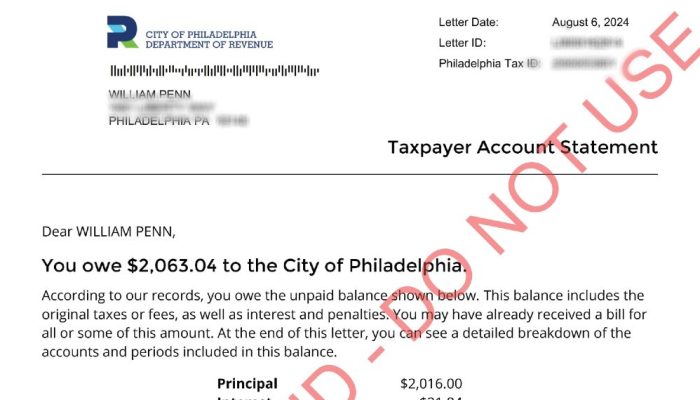

The Department of Revenue sends letters to taxpayers when you have a credit on an account, owe money, or we closed an account of yours. We may also request more information about refund petitions, audits, or tax return errors.

Taxpayers with Philadelphia Tax Center accounts can securely communicate with us online. That way, you don’t have to wait for paper bills or letters. The Tax Center allows you to choose paperless billing, send and receive secure messages, and view and respond to letters. Viewing and responding to letters online saves time and postage costs.

Nevertheless, the law requires us to send certain information by mail. We also understand that some taxpayers prefer receiving printed letters.

Whether you view your letters online or in print, here are five things to do when you receive a mail from us:

-

Don’t panic

Don’t panic if you receive a mail from us, but don’t ignore it either—we’re here to help! We typically send letters about outstanding balances, tax returns, or to ask for more information. Each letter tells you why you’re receiving it and what to do next. You should read the letter carefully and take the necessary next steps.

-

Act quickly

Most letters ask you to take action, such as:

- making a payment,

- applying for tax relief,

- providing more information or supporting documents, or

- getting into a payment plan.

By acting quickly on bill notices, you avoid interest and penalties. You’ll also avoid follow-up billing from Revenue or private debt collection agencies.

The easiest and fastest way to pay is through the Philadelphia Tax Center. You can pay your bills using your smartphone, tablet, or computer. If you can’t pay your debt in full, you can also request a payment plan or enroll in tax assistance programs online.

-

Call us if you have questions

If you have questions, please contact us using the instructions at the end of the letter. Please have your letter and all supporting documents with you before you call.

-

Don’t worry about calling us (unless your letter says you must)

Usually, you don’t have to call or email us when you receive a letter. If you do, the letter will say so. Common scenarios requiring more communication include audits, collection cases, or legal matters.

-

Keep an eye out for scams

The Department of Revenue will never ask you for confidential information by email, social media, or text message. We will ask you to identify yourself when you call us. We usually send bills and letters by mail. If you’re unsure whether you owe past due tax, view your balances at tax-services.phila.gov or call us at (215) 686-6600.

If you’ve created a username and password on the Philadelphia Tax Center, we encourage you to view your letters online. The Tax Center’s online messaging feature is the most secure way to communicate with us. Never send confidential tax or personal information by email or social media.