The tax season clock is ticking down, with roughly one week left to file and pay your Philadelphia income and business taxes without interest and penalty.

Remember, there are no extensions for paying City taxes. You must pay your tax liabilities even if you get an extension to file your 2022 returns. Payments made after the April 18 deadline will incur extra charges. So don’t miss the deadline.

Also, remember to file your business tax returns even if you owe $0. We’re sharing more information about this later in this blog post. But first, here’s a quick refresher for all Philadelphia taxpayers:

For Tax Year 2022:

Philadelphia residents who received a distribution from stocks, bonds, or other investments, including any rental or other unearned income, must file and pay the City’s School Income Tax. The tax rate is 3.79%. You won’t see a payment voucher or return in the mail this year, but you must still file and pay this tax – online is best!

If you conducted business in Philly, you must file and pay the Business Income & Receipts Tax (BIRT), and if your business is not incorporated, also file and pay the Net Profits Tax (NPT). The Net Profits Tax rates are 3.79% for Philadelphia residents and 3.44% for non-residents.

If you live or work in Philly and your employer doesn’t collect and pay the City’s Wage Tax for you, you must file and pay the Earnings Tax. The tax rates are 3.79% for Philadelphia residents and 3.44% for non-residents.

Filing and paying made easy

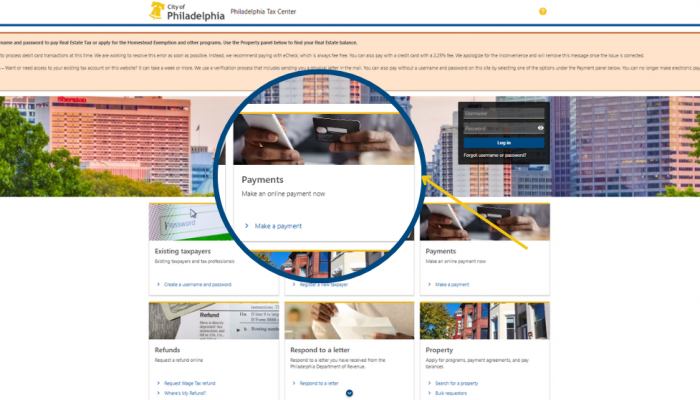

You can securely file and pay all four taxes on the Philadelphia Tax Center –here’s how to file:

- Log into your Philadelphia Tax Center profile at tax-services.phila.gov

- Scroll to the summary subtab to find your BIRT, NPT, Earnings Tax, or SIT account.

- To the right of the screen, select “File, view, or amend returns.”

- Follow the prompts to submit your returns.

Follow these steps to pay online:

- Find the “Payments” panel on the right side of the Philadelphia Tax Center’s homepage.

- Select your preferred payment method and follow the prompts to submit your payment. eCheck payments are always free of processing charges, but credit card payments come with a service fee.

You must still file

As noted above, anyone conducting business in Philadelphia must file the BIRT and, if you are not incorporated, NPT returns. You must file these returns regardless of profit or loss. This is the only way to fulfill your business tax filing obligation and keep you in compliance.

If you have an active Philadelphia tax account but didn’t conduct any business activity in 2022, you should file the BIRT No Tax Liability (NTL) form to account for this tax period. If you need to file for the NPT, you should report a “zero tax due” return. This is the best way to avoid getting a non-filler notice.

If you closed your business last year, you must still file your business tax returns for that final year. You no longer have to file taxes if you complete this Change Form to close your business entity’s Philadelphia tax account.

Don’t owe the BIRT? File the NTL form!

You don’t have to file the BIRT if you have less than $100,000 in gross receipts for 2022. But you must still report your activity by filing a No Tax Liability to let the City know you owe no BIRT tax. To do this:

- Log into your Philadelphia Tax Center profile at tax-services.phila.gov

- Find your BIRT account, and select “File, view, or amend returns.”

- Pick “File now” on the “Returns” screen.

- Carefully review your tax information and hit “Next.”

- Enter your liability amount on the “Tax liability” screen and hit “Next.” If your liability amount is less than $100,000, you will be prompted to file a No Tax Liability instead. Follow the on-screen directions to complete the process.

Got additional filing questions or need help with your returns? Please email revenueaudit@phila.gov.