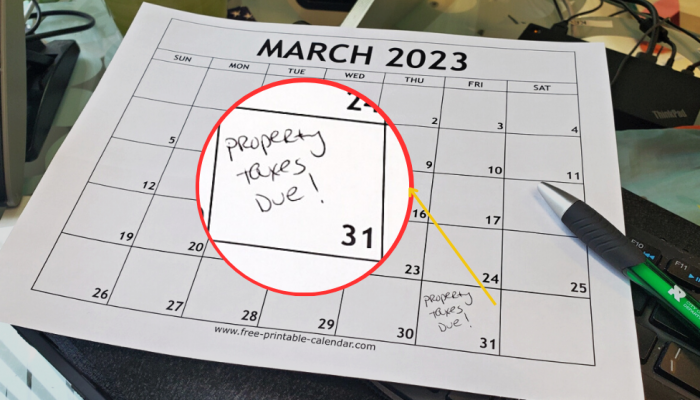

You owe Philadelphia’s Real Estate Tax if you own a property in the city. The tax is due once a year, on March 31, and is based on your property’s assessed value, which is determined by the Office of Property Assessment (OPA).

It is always best to pay your property tax on time and in full, as this tax provides funding for the local school district, police, and fire departments, among other essential City services. You can shut the door on added charges if you pay your current-year bill in advance of the due date. Here are your payment options:

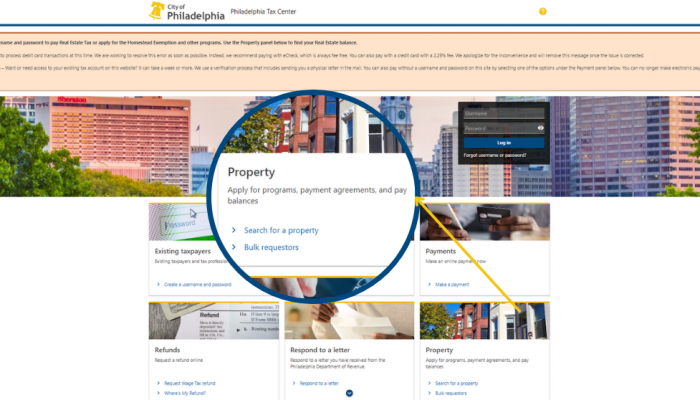

Online

The best way to pay your Real Estate Tax is online at tax services.phila.gov. Find the “Property” panel on the site’s landing page to get started, or select “Make a payment” under the “Payments” panel. Keep in mind that eCheck payments are always free of processing charges. You’ll be charged a fee if you pay with a debit or credit card.

Over the phone

You can pay your bill by phone; just call (833) 913-0795 and follow the prompts through the process.

In-person

If you really must pay in person, we recommend scheduling an appointment before visiting our Center City (Municipal Services Building, MSB) and Northeast satellite offices. You can schedule your payment appointment online or by calling (215) 686-6442 and pressing #3. Please note that cash payments are only accepted at our Center City location. Remember to bring your 2023 Real Estate Tax bill to your appointment.

By mail

If you would rather mail in a check or money order, make sure to include your payment voucher, write your OPA number on your check, and mail your payment to:

Philadelphia Dept. of Revenue

P.O. Box 8409

Philadelphia, PA 19101-8409

You can reprint your payment voucher by using the “Payment” panel on the Philadelphia Tax Center’s home page. Click on the “Search for a Property” link and follow the instructions to view your property. From your property’s summary page, click on the link that says, “Make a payment” and follow the instructions. Choose “Pay by mail” when prompted.

Get help

If you can’t pay your bill in full, don’t wait for the March 31 deadline to contact us! Please call (215) 686-6442 today and ask about our property tax payment plans.

Even better, go to tax-services.phila.gov to apply for a current-year Installment Plan to pay your bill month-to-month without interest or penalty. The Real Estate Tax Installment Plan program is helping thousands of low-income and senior citizen homeowners take care of their property tax bills. New participants can pay their bills in eight installments in the first year, but you must act fast, as March 31 is also the deadline to apply for this program!

More help is available to homeowners who live on their property, including veterans, senior citizens, and low-income families. Just call (215) 686-6442 and ask for Real Estate Tax assistance.