We’re back to that time of year—tax season. We understand it’s a hectic time for many taxpayers and preparers, but we’re ready to work with you to solve problems as they arise. Four Philadelphia business and income taxes are due this tax season: Business Income & Receipts Tax (BIRT), Net Profits Tax (NPT), Earnings Tax, and School Income Tax (SIT). Make sure to file and pay them by April 18 to avoid added interest or penalty. Here are four things to keep in mind as you prepare to file:

File and pay taxes online

This is the quickest and most secure way to file and pay all City taxes. While you don’t need a username and password to pay taxes on the Philadelphia Tax Center, you must be logged in to file your returns. Here are the steps:

- Log into your Philadelphia Tax Center profile.

- Scroll to the summary subtab to find your BIRT, NPT, Earnings Tax, or SIT account.

- To the right of the screen, select “File, view, or amend returns.”

- Follow the on-screen direction to submit your returns.

You may owe School Income Tax

If you took a distribution from stocks, bonds, or other investments in 2022, had any other unearned income, and you’re a resident of Philadelphia, you owe the City’s School Income Tax (SIT). This tax applies to unearned income residents get from investments rather than wages. The tax rate is 3.79%, and it’s due April 18, 2023. Unlike previous years, you won’t see a payment voucher or return in the mail this year, but you can easily file and pay this tax online.

To file:

- Log into your Philadelphia Tax Center profile at tax-services.phila.gov,

- Find your SIT account to get started with your 2022 return,

- Carefully read and follow the on-screen directions to submit your return.

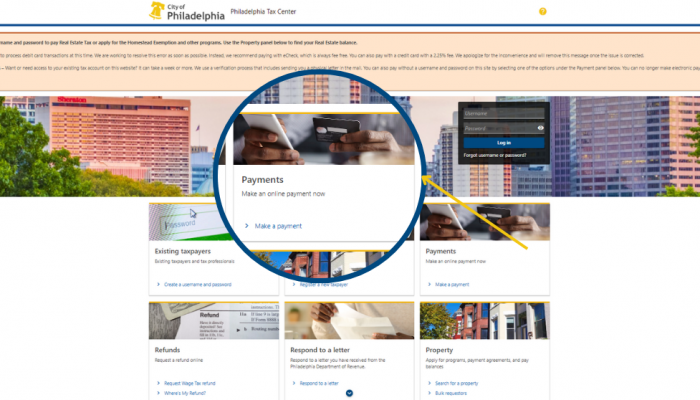

To pay:

- Find the “Payments” panel on the right side of the Philadelphia Tax Center’s homepage.

- Select your preferred payment method and follow the prompts to submit your payment. Using eCheck is always free of processing charges, but credit card payments come with a service fee.

Submit W-2s, 1099s online

Employers and payroll service providers should use the Philadelphia Tax Center to submit W-2s and 1099s to the City. The process is fast and secure. Even if you missed the February 28 submission deadline, you should still submit your documents through the Philadelphia Tax Center. You can no longer use our old eFile/ePay system for W-2 and 1099 submissions. You’ll need your Philadelphia Tax Center username and password to submit your forms online.

Employers and payroll service providers should use the Philadelphia Tax Center to submit W-2s and 1099s to the City. The process is fast and secure. Even if you missed the February 28 submission deadline, you should still submit your documents through the Philadelphia Tax Center. You can no longer use our old eFile/ePay system for W-2 and 1099 submissions. You’ll need your Philadelphia Tax Center username and password to submit your forms online.

Share the news about these federal tax credits

Did you claim the Federal Earned Income Tax Credit (EITC) for tax year 2022? Congratulations! You’ve just earned yourself additional income this tax season. But thousands of eligible Philadelphians don’t take advantage of the program, leaving over $100 million on the table. Philadelphians between ages 25 and 65 or with a qualifying child should claim this credit when filing their 2022 federal tax returns. Depending on filing status, they may get up to $6,935 in refunds! Even if they didn’t claim EITC for past years, they can amend their returns for those years and still get the credit—going as far back as three years (2021, 2020, and 2019)! Share our EITC resources webpage and help Philadelphians claim this important credit.

Like EITC, the Child Tax Credit (CTC) is a federal tax refund program putting money back in the pockets of families at tax time. You can get up to $2,000 per qualifying child, regardless of your working status! Visit our Child Tax Credit resources webpage to learn more about how to claim this credit as you prepare to file your 2022 federal returns.