Most Philadelphia property owners have already paid their 2022 Real Estate Tax. If you haven’t paid your bill, it is important to do so by December 31. Your account balance will only grow if you fail to beat this deadline.

The countdown begins now; you have less than a month to shut the door on extra charges being added to your balance. Paying now will also protect your account from being transferred to a collection agency or law firm.

If you don’t pay by December 31, your account will become delinquent on January 1. At that point, the City will put a lien on your property and add legal fees that would increase the size of your debt.

You can beat the clock by:

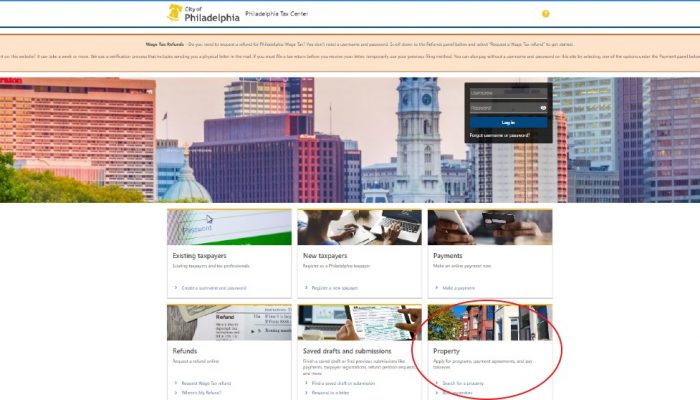

Paying online – you can look up your balance and pay your bills on the Philadelphia Tax Center. The process is safe, fast, and convenient. It is also the best way to pay Philadelphia Real Estate Tax moving forward. To search and pay:

- Go to tax-services.phila.gov.

- Find “Search for a property” under the “Property” panel. You only need your address or OPA number to access your property on the Philadelphia Tax Center. A username and password are not required.

- Enter your street address on the “Search for a property” screen and hit “Search.” Your property’s OPA number will appear in blue on the right side of this same screen. Select it and proceed to the next screen, where you can view a summary of your property account. This screen also lets you “Make a payment,” “View period balance,” “Apply for real estate assistance programs,” and “View liens and debt.”

Another quick way to pay online is by selecting “Make a payment” under the “Payments” panel on the Philadelphia Tax Center’s homepage. Choose “Yes” to pay a current year’s bill, and enter the Letter ID at the top of your bill to proceed with your payment.

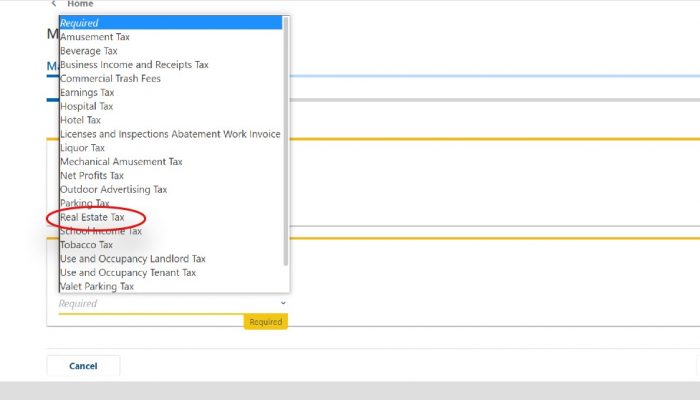

Owners looking to pay past due bills should pick “No” on this screen and use the dropdown menu to select “Real Estate Tax.” Follow the onscreen directions to complete your payment. Remember, paying with eCheck is always free of processing charges.

While you don’t need a username and password to pay online, customers who own or manage multiple properties should consider creating a username and password. This way, you can see all balances on your properties from a single dashboard.

If you miss your bill in the mail or it’s lost, you can easily find your property tax balance on the Philadelphia Tax Center. Just search your property using the “Property” panel on the site’s homepage and follow the prompts to find your property and pay any pending balances. Again, a username and password aren’t required.

You can also pay your bill by:

- By phone by calling (877) 309-3710,

- In person, at the Municipal Services Building (MSB), across from City Hall, or

- By mail by sending your payment to:

Philadelphia Dept. of Revenue

P.O. Box 8409

Philadelphia, PA 19101-8409

Help is available

Paying your property tax bill in full and on time is always best, but we understand that some owners can’t afford to pay all their bills in full. If this is your case, don’t wait to contact us! The Department of Revenue offers several payment agreements with flexible terms for homeowners. You can also take advantage of a range of Real Estate Tax relief programs.