The City of Philadelphia recently launched an online calculator to help residents estimate their 2023 property tax bills. The Real Estate Tax estimator is available on the property.phila.gov website. It was launched soon after the Office of Property Assessment (OPA) released new assessments for over 580,000 Philly properties.

The 2023 preliminary values were released online on May 9. Property owners can look forward to receiving written notices with their new assessments by September of this year. But why wait when you can easily estimate your bill today? The tool lets you estimate your tax in two simple steps. Here’s how:

- Go to https://property.phila.gov/,

- Enter your address (street name and number) in the “Search the map” box and press “enter” on your keypad.

Make sure to enter your address correctly.

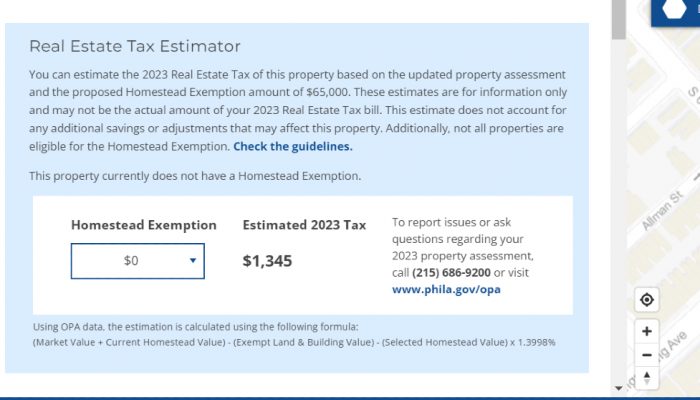

Besides knowing what your next property tax bill would be, the estimator lets you know if you have the Homestead Exemption or not. If you do, the tool estimates the effect of the current and the Mayor’s proposed Homestead amounts on your next bill.

Property owners with the Homestead Exemption will see a number greater than zero (0) in the “Homestead Exemption” box. Use the drop-down menu to see the effect of the current and proposed Homestead amounts on your “Estimated 2023 Tax” bill.

The Homestead Exemption is available to Philadelphians who own and live in their homes. The program works by reducing your annual property tax bill by up to $629. But this amount and tax rate could change should City Council pass the Mayor’s proposed increase.

If you are not currently enrolled in the program but think you may qualify, it’s easy to apply. You can apply online or mail in an application.

Please understand that the new tool only provides estimates, which may not be accurate for owners who receive property tax abatements or are currently enrolled in the Longtime Owner Occupants Program (LOOP) or the Senior Citizen Tax Freeze program.

Philly’s residential, commercial, industrial, and institutional property owners last saw changes to their assessments in 2020. OPA’s new assessments come with expanded Real Estate Tax relief for Philadelphia homeowners.

Although legislation is not final, expect to see an expanded Homestead Exemption. Now is the time to enroll in the Senior Tax Freeze program, which helps vulnerable Seniors afford their property tax bills. Not a senior or homeowner yourself? Please let a neighbor or family member know that we have programs that can help. Visit our Real Estate Tax relief webpageto learn more.