Are you an employer or payroll company submitting W-2s to the City of Philadelphia? The easiest way to submit your forms is through the Philadelphia Tax Center. Even if you missed the February 28 submission deadline, you should still submit your documents through the Tax Center. The process is secure and easy.

Remember, employers or payroll service providers with 250 or more employees must use the Philadelphia Tax Center to submit W-2 forms. You can no longer use our eFile/ePay system for W-2 submissions.

Only employers and payroll companies should submit W-2s to the City. Individual Wage Taxpayers don’t have to submit their own W-2s—your employer will do that for you.

If you’ve filed the 2021 Annual Wage Tax Reconciliation return online, you must still submit a W-2 file through the Philadelphia Tax Center. The good news is that our new tax filing and payment website allows you to submit W-2s as text or Excel files.

Here’s how to get started:

- Go to https://tax-services.phila.gov to log into your Philadelphia Tax Center profile. You will need your username and password for this.

- Once logged in, select “More options.”

- Pick “W-2 upload” under the “1099s and W-2s” tab.

- Read the submission instructions before selecting “Next.”

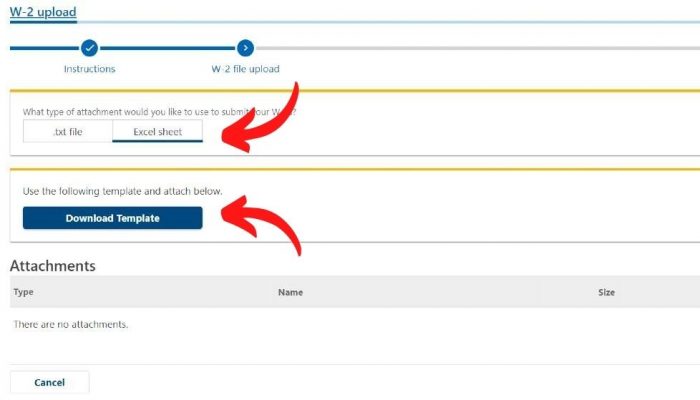

- Pick a file format for your W-2s. You can choose to upload your documents as text or Excel files.

If you select “Excel,” the website will prompt you to download a template. Use this template to capture all the information we require to process your submission. Once you’ve completed the template, select “Add” to upload each of your W-2s as attachments. Then, select “Submit” to complete your submission.

You must be logged in to submit W-2s online. If you don’t have a Philadelphia Tax Center login, please select “Create a username and password” on the home screen to create them. Be aware that it will take you a week or more to complete the verification process when you use the Tax Center for the first time.

Third-party tax professionals can also submit W-2s online on behalf of their clients. Once logged into the Tax Center, find “Accountant Center” and select the “1099 and W-2s” tab to upload your forms.

While employers with fewer than 250 employees are not required to submit electronic files, we strongly recommend using the Philadelphia Tax Center to submit your W-2s. If you prefer submitting them by mail, please send your forms to:

Philadelphia Department of Revenue,

PO Box 1670

Philadelphia, PA 19105

If you have trouble uploading W-2 forms, please send us a secure message through your Philadelphia Tax Center profile.