We’re only two weeks away from the start of the New Year, which is also the beginning of the tax season. The 2022 tax season will be marked by the debut of the Philadelphia Tax Center. It’s the first year you will be filing most business taxes on our new tax website. Here are three things to keep in mind as you prepare:

- Do use the Philadelphia Tax Center

This is the best way to file your 2021 returns for the following taxes: Business Income & Receipts Tax (BIRT), Net Profits Tax (NPT), School Income Tax (SIT), Earnings Tax, Wage Tax, Tobacco, Beverage, and Liquor Tax.

Our new tax filing and payment website allows you to quickly, easily, and securely file your returns electronically. But you can continue to mail in paper returns for BIRT, NPT, SIT, Earnings, and Wage taxes if you prefer.

Nevertheless, returns for the Liquor, Tobacco, and Beverage taxes can only be filed electronically using our new tax website.

- Do use your Philly tax ID

You may have noticed an addition to the digits in your Philly tax ID numbers. They are now ten digits long and are called Philadelphia Tax Identification Numbers or PHTINs. These changes became effective on November 1 when we launched our new tax system.

Using your PHTIN is the best way to avoid refund and processing delays. But don’t worry, you can still use your old numbers to conduct business with our department.

However, please don’t substitute your PHTIN for your Federal Employer Identification Number (EIN). We tie your Philly returns to your PHTINs and are unable to process your returns using your federal number.

- Don’t pay 2022 Real Estate Tax in the Philadelphia Tax Center

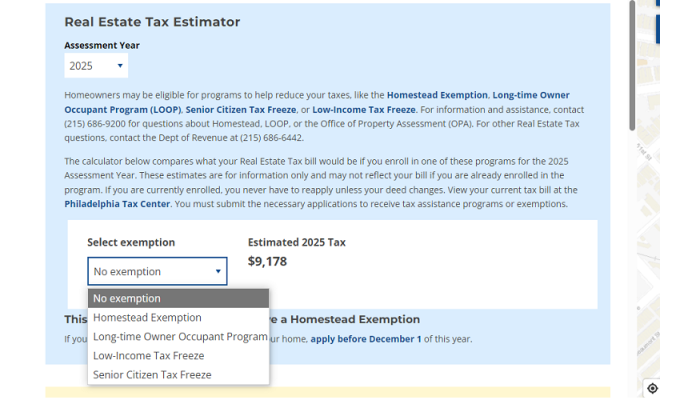

The Philadelphia Tax Center will not include Real Estate Tax this year. Please continue to use our property tax search website to pay your property tax bills until October 2022, when this tax is added to our new tax website.

Likewise, don’t file or pay the following taxes in the Philadelphia Tax Center this year: Use and Occupancy Tax, Realty Transfer Tax, Hospital Tax, Parking Tax, Valet Parking Tax, Hotel Tax, Amusement Tax, Coin-operated Tax, Vehicle Rental Tax, Outdoor Advertising Tax, Commercial Trash Fees, Police Fees, and Agency Receivable Fees.

Please continue to use our eFile/ePay website to file and pay these taxes and fees until October 2022, when they become available in the new system.

Need more information or got a question? Call us at (215) 686-6600 or email us at revenuetaxadvisors@phila.gov. If you need help with filing procedures, email us at revenue@phila.gov.