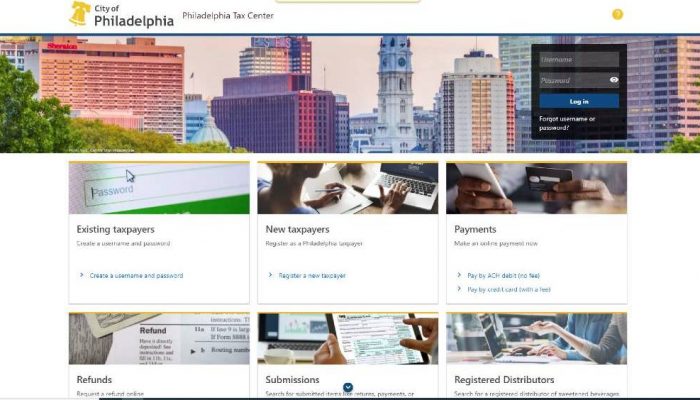

Philadelphia’s Earnings Tax filers will soon have the option to file their returns electronically. Currently, Earnings Tax is one of the City’s major individual tax forms that must be filed on a paper form. When the City unveils its new tax website this Fall, Earnings Tax will join the long list of returns taxpayers can file online.

The Philadelphia Tax Center will make filing and paying Earnings Tax more convenient than ever. On average, 11,000 Earnings Tax returns are filed by Philly taxpayers every year.

You can file up to three prior years’ returns online, using the Philadelphia Tax Center. You can still complete your Earnings Tax return or paper form, and mail it in, if that is your preference. But moving forward, the Philadelphia Tax Center will be the best way to file and pay Earnings Tax.

New website, new services

The City’s new tax center includes other, previously unavailable services, such as:

- Sending secure messages to the Department of Revenue.

- Submitting payment agreement and refund requests.

- Viewing and managing your account from a single dashboard.

Philadelphia’s Earnings Tax applies to salaries, wages, commissions, and other compensation paid to you as an employee. It is a self-pay and -file tax. If your employer doesn’t collect and pay the City’s Wage Tax on your behalf, you need to file and pay Earnings Tax for yourself.

The Philadelphia Tax Center is designed to provide faster, safer access to online tax filing and payment. It becomes available to business taxpayers in November 2021. Property taxes will be added to the Philadelphia Tax Center in October 2022.