Starting in November 2021, Philadelphia taxpayers can choose to receive their business tax bills, notices, and other paperwork electronically. The City is switching to a new tax system that allows taxpayers to take advantage of paperless billing.

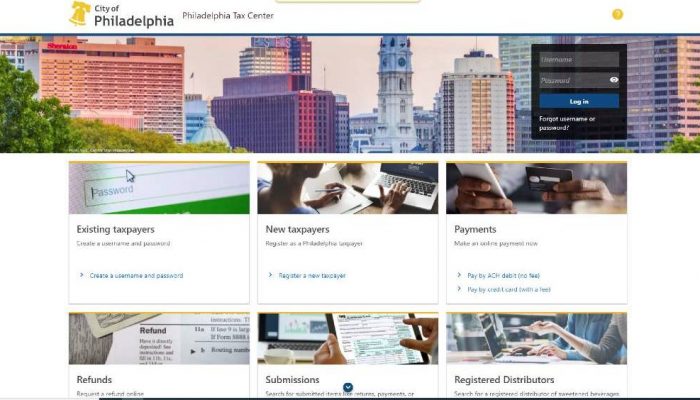

The new Philadelphia Tax Center is designed to make tax filing and payment as easy and convenient as possible. To take advantage of the new, paperless feature, you must sign up for an account starting November 1.

When you sign up for a Philadelphia Tax Center account, you:

- Will be defaulted to paperless billing.

- Can file and pay most of your business taxes online.

- Don’t have to wait for a paper bill or letter in the mail.

The system also allows users to electronically view and respond to all letters from the Department of Revenue. This saves you time and postage costs. You can upload any document using your phone or a computer from your home or office.

Furthermore, you can use the new website to directly apply for credits, request refunds, or check the status of new refund requests.

Opting to go paperless or “green” saves time, costs and benefits the environment. But we understand that certain tax documents cannot be communicated digitally.

Some taxpayers prefer to receive their notices and bills by mail. These taxpayers can continue to enjoy this service.

If you have signed up for a Philadelphia Tax Center account but prefer to receive paper bills and notices, you can log into your account and opt to receive hard copies of your tax statements and notices. You have an option to do this for all or select taxes.

The new website will not include all City taxes this year. Property owners will be able to pay their Real Estate Tax bills in the Philadelphia Tax Center starting in 2022.