The COVID-19 health emergency continues to limit the Department of Revenue’s interactions with water customers and taxpayers. While keeping the public and our staff safe, we are striving to adjust our services to meet this unprecedented moment.

Our customer service reps are now equipped with a new system to quickly and effectively address your questions over the telephone.

Need help with your water or tax account? Provide us with your name and phone, and we’ll call you back within 24 hours! We will do our best to solve your issue on the call. The call back is also a way to schedule an in-person appointment when necessary.

The best way to request a call back is online.

Request a call back online

From the Department of Revenue’s homepage (www.phila.gov/revenue), select “Request a telephone call back,” from our special COVID-19 updates section.

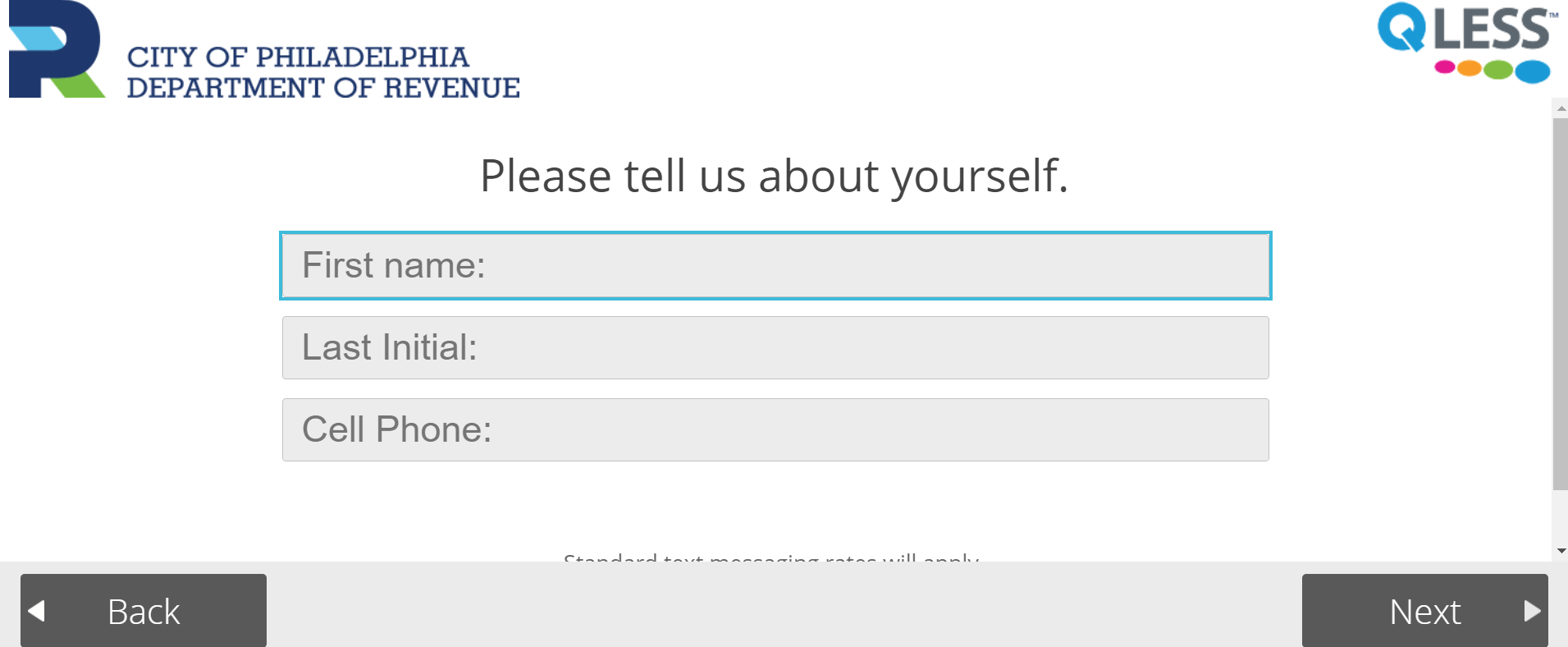

Our telephone call back portal will ask you to provide your:

- First name,

- The initial of your last name, and

- Cell phone number.

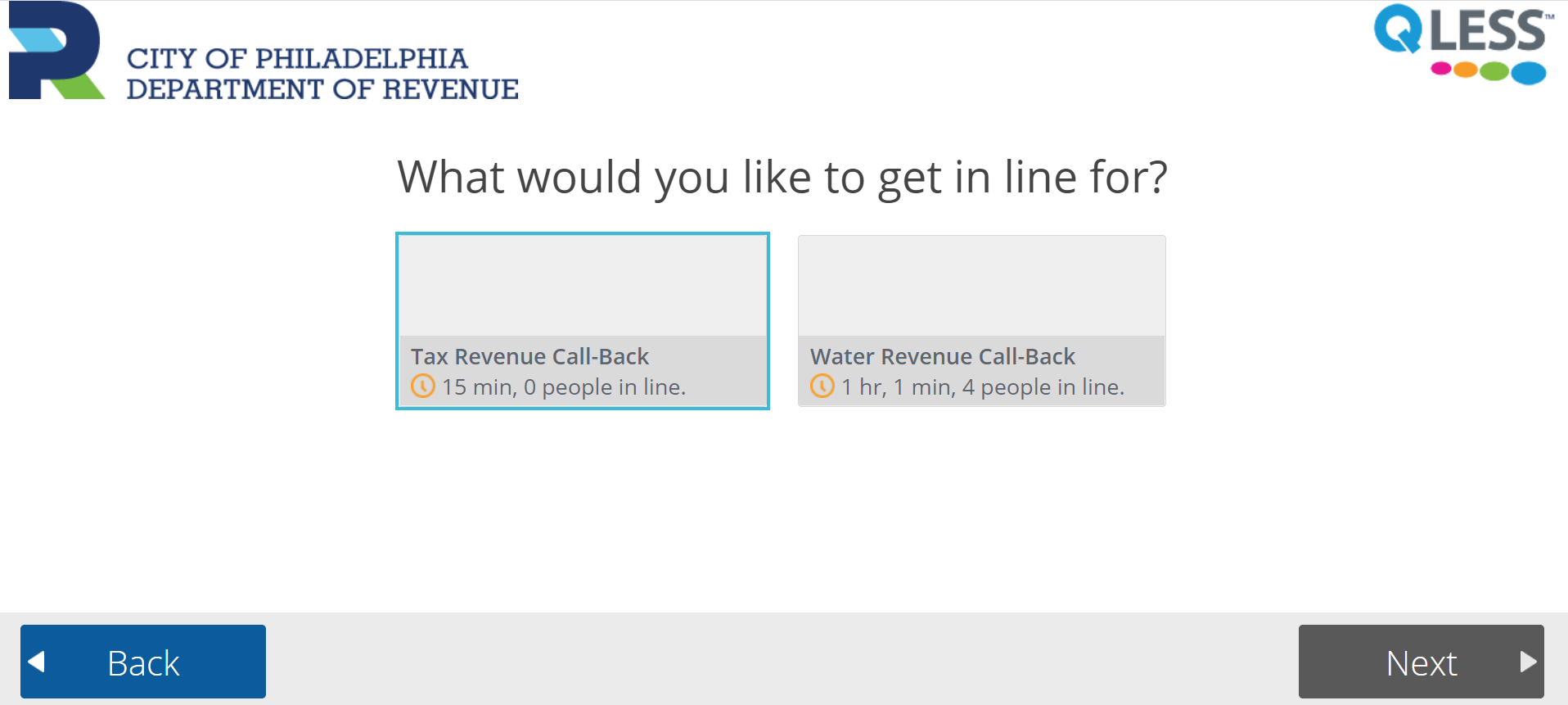

On the next screen, choose a call back from a Tax representative, or a Water representative.

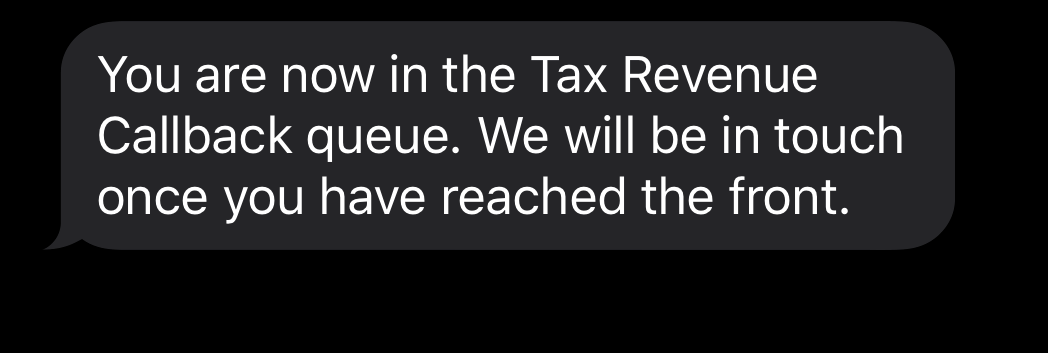

After you submit the online form, you will receive a cell phone text message confirming your place in the call-back queue.

When it’s your turn, one of our representatives will call your phone. Be ready to share information that will help the representative solve your issue, such as a Water Access Code (found on your bill).

Request a callback by phone

Water customers can also call (215) 685-6300 and leave a message to receive a call back. When prompted, press #0, then #3 and follow the instructions.

- Be sure to include your name, phone number, and email address in your message.

- A water representative will return your call within 24 hours.

Tax customers can continue using our Taxpayer Services hotlines:

- (215) 686-6600 (for business tax), and

- (215) 686-6442 (for Real Estate Tax)

We appreciate your patience as we roll out new customer service systems and procedures, such as this one.