The best way to file and pay your City of Philadelphia taxes and water bills is always online. When you can’t, we encourage paying property taxes or water balances over the telephone.

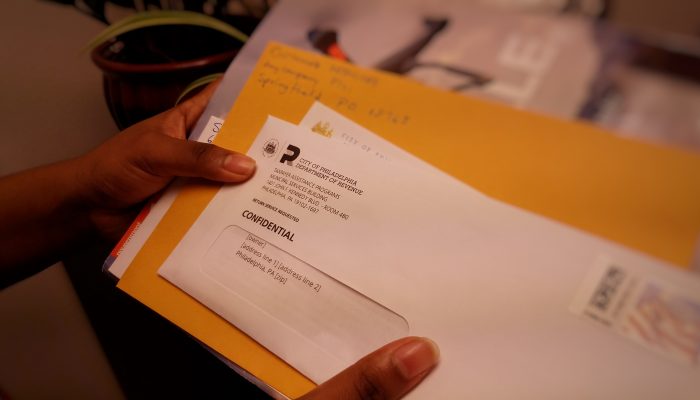

Another option is mailing your forms and payments to the Department of Revenue. Different processing units within the Department use different P.O. Boxes for paper correspondence.

To make sure we get your form or payment, and process it in a timely matter, please use the right mailing address. Different tax types and forms have different P.O. Boxes:

Tax type or form: |

Mailing address: |

|

| Real Estate Tax (including installment payments) | Department of Revenue P.O. Box 8409 Philadelphia, PA 19101-8409 |

|

| Water bills | Water Revenue Bureau P.O. Box 41496 Philadelphia, PA 19101-1496 |

|

| Business Income & Receipts Tax (BIRT), Net Profits Tax (NPT) | Returns:

Philadelphia Dept. of Revenue |

Payments:

Philadelphia Dept. of Revenue |

| School Income Tax (SIT) | Philadelphia Dept. of Revenue P.O. Box 389 Philadelphia, PA 19105-0389 |

|

| Wage Tax | Philadelphia Dept. of Revenue P.O. Box 8040 Philadelphia, PA 19101-8040 |

|

| Earning’s Tax | Philadelphia Dept. of Revenue P.O. Box 1648 Philadelphia, PA 19105‐1648 |

|

| Streets commercial trash | Philadelphia Dept. of Revenue P.O. Box 966 Philadelphia, PA 19105-966 |

|

| General refund petition form | Philadelphia Dept. of Revenue P.O. Box 53360 Philadelphia, PA 19105 |

|

We understand some taxpayers and water customers prefer in-person service. But as the City takes measures to limit the spread of COVID-19 coronavirus in Philadelphia, face-to-face customer assistance, for now, is not an option.

For other updates related to the City’s COVID-19 response, including when offices will re-open, please text “COVIDPHL” to 888-777.