By Grant Holland, Revenue Policy Analyst

October saw the second and fourth largest lottery drawings in American history. Unfortunately, a Philadelphian did not have the winning ticket for either jackpot. But thousands of lucky Philadelphians win smaller cash prizes from instant games and lottery drawings each year.

So, what happens when you finally hit the lottery? Before you go off buying mansions for you and all your friends, you should know that not all the winnings end up in your pocket. Like your regular paycheck, lottery winnings are taxed. If you’re a winner, you will owe taxes to the federal and state governments, and the City of Philadelphia’s School Income Tax (SIT).

Funding for the School District

SIT is one of a handful of taxes collected by the Department of Revenue for the School District. It is a tax on certain types of unearned income that applies only to city residents. Unearned income comes from sources other than a job. Types of taxable unearned income include:

- Dividends

- Royalties

- Short-term rental income

- Interest (Checking & Savings accounts, and some government bonds are exempt)

- Cash lottery winnings

The rate for 2018 is 3.8809% (same as the residential Wage Tax). If a Philadelphia resident has unearned income, a return must be filed by April 15 each year.

SIT has been around since 1967, but cash lottery winnings were only added to it starting in 2016. In that year, nearly 500 Philadelphians won prizes of at least $3,000. These winners were mailed notices that they may owe SIT. Tax collections for the School District from these winners totaled nearly $250,000.

SIT on the rise

During Fiscal Year 2018, the Department of Revenue collected $48 million in SIT for the School District (see interactive graph below). This amount has nearly doubled over the past ten years, driven in part by data partnerships and better communication. The Department of Revenue uses IRS data and identifies taxpayers who may owe SIT. Based on the findings, we send out notices to thousands of taxpayers. These notices encourage compliance and increase collections. Because of these efforts, SIT’s share of all taxes collected for the School District has grown.

What to do if you owe SIT?

Forgotten to file, or think you may owe SIT from 2017 or earlier? It is not too late to file a return or pay tax balances. The City is stepping up SIT enforcement and sending out notices to SIT non-filers and filers that underreport income. Failure to report, including underreporting SIT income can result in significant penalties and interest. SIT returns can be filed and paid online via Revenue’s online portal. All you need is a Tax Account and PIN to get started.

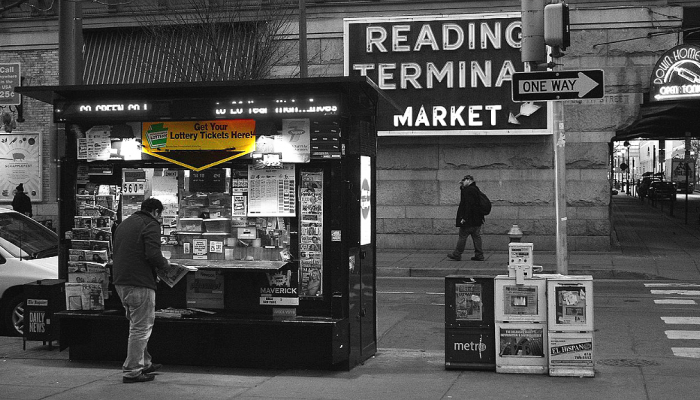

Photo credit: Mobilus in Mobili / Flickr