City Releases Data Demonstrating Strong Employment in Sectors Affected by the Philadelphia Beverage Tax

PHILADELPHIA – The City of Philadelphia today released data on unemployment claims and Wage Tax collections for those sectors most likely to be affected by the Philadelphia Beverage Tax (PBT), figures that cast doubt on industry assertions of job losses as a result of the tax.

“While the beverage industry has spent more than a year spouting self-reported and unsubstantiated claims of job loss, we’re focused on studying actual data,” said Mayor Kenney. “Unemployment claims and Wage Tax collections offer empirical proof that the sectors most directly affected by the tax are seeing steady employment if not growth.”

Unemployment Claims

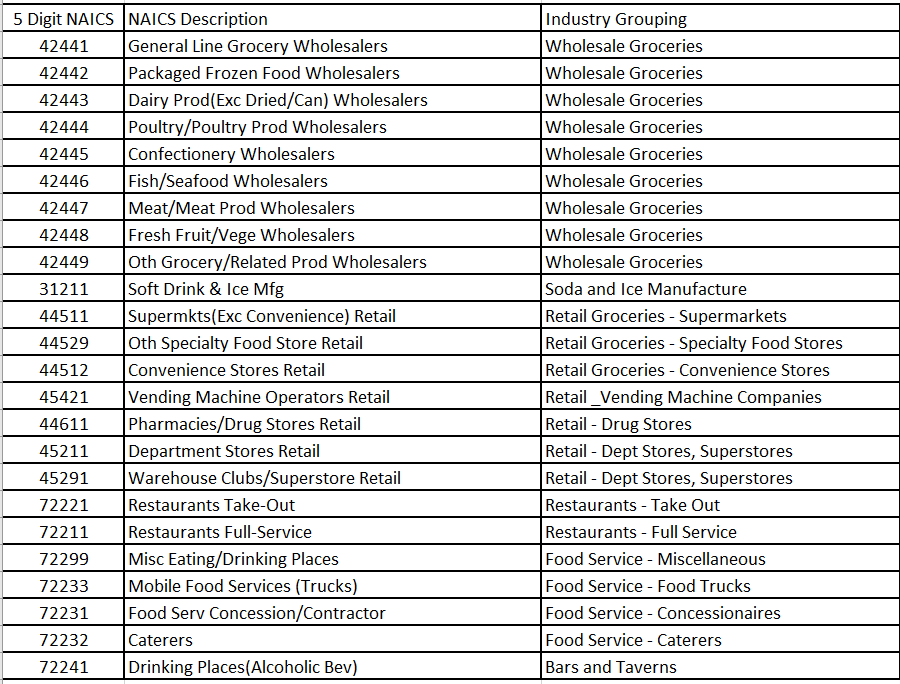

The unemployment figures, culled from State Department of Labor data, show that new unemployment claims filings for industries potentially impacted by the PBT decreased by 10 percent in Philadelphia and 8 percent in the surrounding counties during the first year the tax was implemented, January – December 2017.

The same numbers show that total new unemployment claims filings for all industries in Philadelphia dropped 5 percent the first year of the PBT.

Trends in unemployment benefit claims filings are similar in Philadelphia and the surrounding counties before and after the PBT, with no indication that unemployment increased following the PBT. Surrounding counties analyzed include Delaware, Montgomery and Bucks.

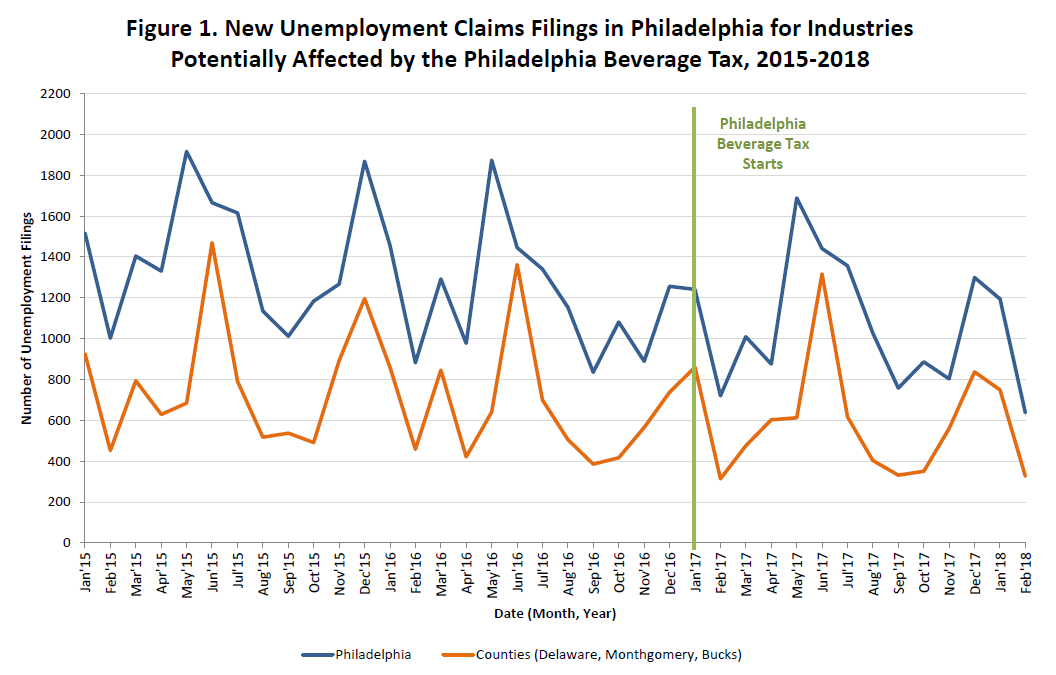

For example, data from supermarkets show a very pronounced spike in unemployment claims following the Bottom Dollar and Pathmark closures around October 2015, but no increases following the PBT:

Wage Tax Collection

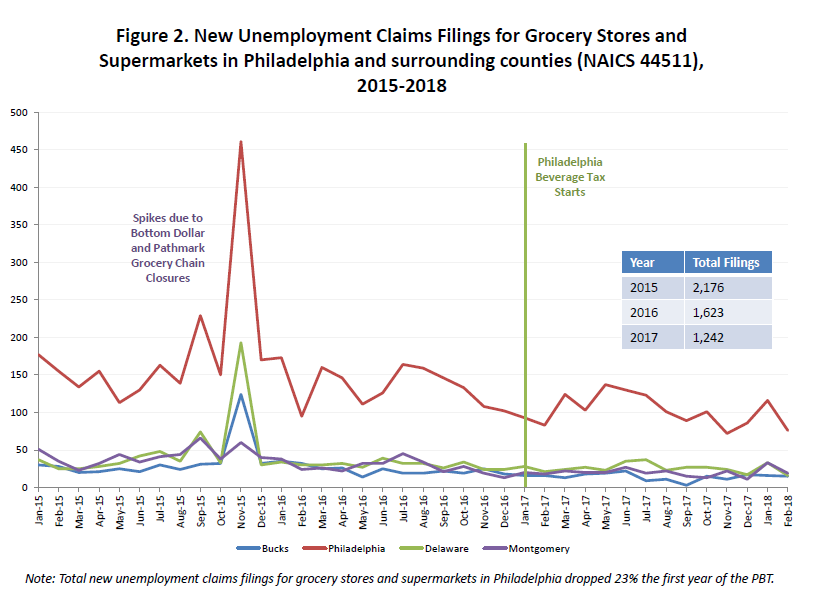

The City’s Wage Tax data show that annual collections from all PBT-affected industries increased 6.2 percent from 2015 to 2017. Additionally, more businesses within these affected industries are remitting Wage Tax, with an increase of 5.2 percent reporting over the two-year period.

The numbers also show that restaurants, which make up a third of Wage Tax collections for PBT-affected industries, have shown strong collection results. Revenue reported a 10.3 percent increase in Wage Tax collections for this sub-sector from 2015-2017.

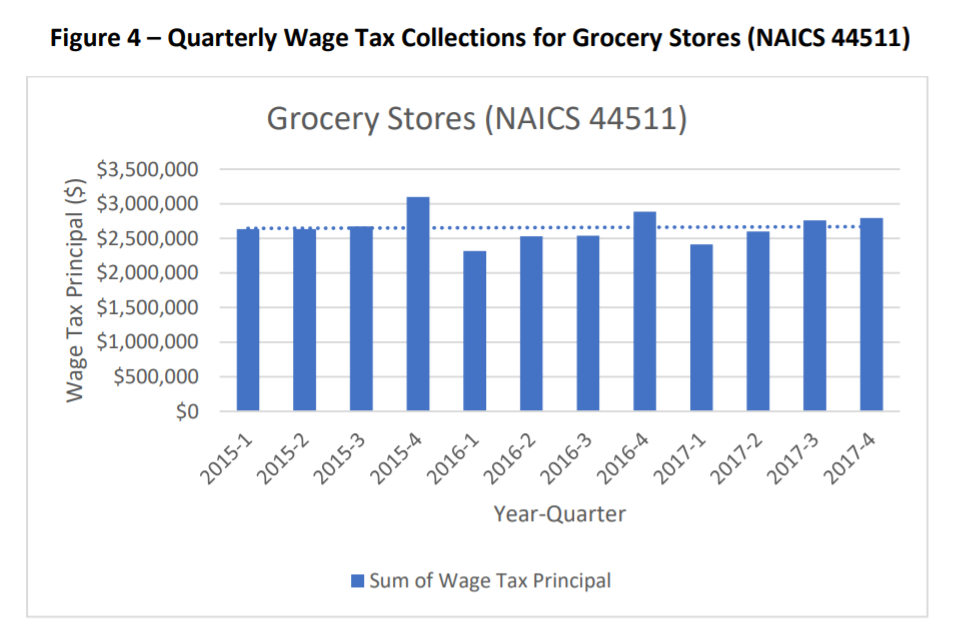

Wage Tax Collections from grocery stores increased slightly after the beverage tax. Revenue numbers show that collections from this group declined 6.9 percent from 2015 to 2016, prior to the tax, and then rebounded 2.9 percent from 2016 to 2017. When looking at longer trends, 2017 collections from grocery stores were only 0.1 percent less than the 2012 to 2016 five-year average.

In other sectors, the Philadelphia Beverage Tax has been a job creator. In its first year, the tax created 250 new living wage jobs in early education and 120 summer job and career exposure experiences for students. Ninety neighborhood residents have also gained employment through trainings hosted by PBT-funded Community Schools. Rebuild, the ambitious renovation of our parks, rec centers and libraries will also provide many Philadelphians with a lifelong career in the trades.

The PBT generated nearly $79 million in its first 12 months. That money has given over 2,700 three- and four- year old children the opportunity to access free, quality pre-K. At the same time, it has served over 6,000 students and their families through 11 Community Schools — public schools that offer expanded medical services, after-school programming and job training.

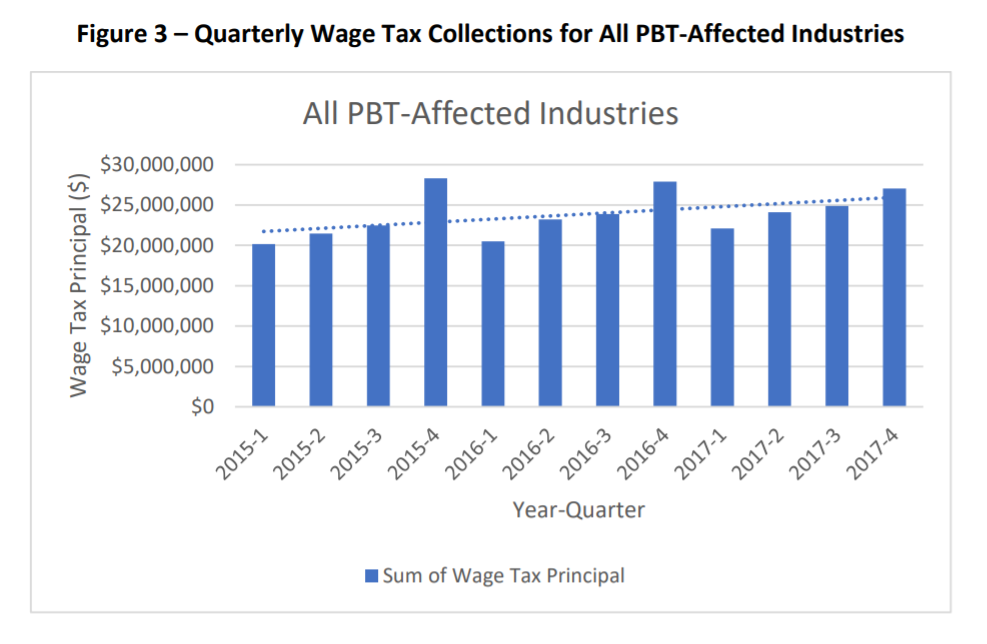

The following are the sectors included in the analyses of the unemployment and Wage Tax data: