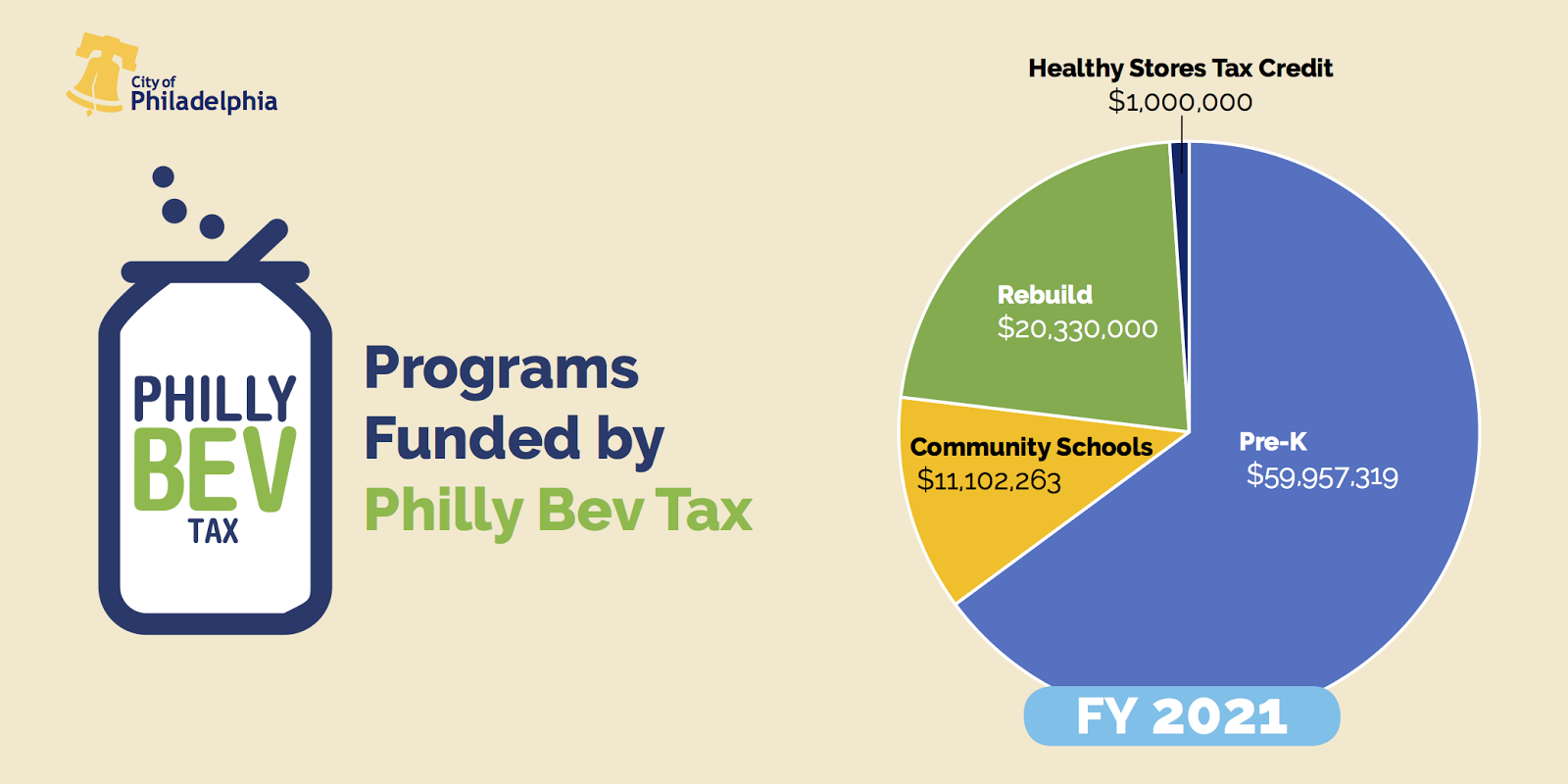

How does the tax break down?

The Philadelphia Beverage Tax, passed by City Council and signed into law by Mayor Kenney on June 20, 2016, provides revenue the City is using to fund three critical anti-poverty programs: PHLpreK, Community Schools, and Rebuilding Community Infrastructure (Rebuild). Beginning on January 1, 2017, the City began collecting the Philly Bev Tax on the distribution of sweetened beverages.

By fiscal year 2021 (July 2020 – June 2021), 99% of the tax will go directly to pre-K, Community Schools, and Rebuild. The remainder will be used for the Healthy Stores Tax Credit to help businesses sell healthier beverages.

By fiscal year 2021 (July 2020 – June 2021), 99% of the tax will go directly to pre-K, Community Schools, and Rebuild. The remainder will be used for the Healthy Stores Tax Credit to help businesses sell healthier beverages.

Learn more about why PHLpreK, Community Schools, and Rebuild are so critical to Philadelphia’s future. You can also find out more about the Philly Bev Tax.

What is the Philly Bev Tax doing so far?

-

Funding 2,000 free, quality pre-k seats. These seats are budgeted to grow to 6,500 over the life of the program. Of the families who enrolled in PHLpreK, the mean household income was $31,776 annually.

-

Growing minority and women owned businesses. 86 pre-K programs are growing their businesses by participating in PHLpreK. Of these small businesses, 75% are owned by women and/or minorities.

-

Over 250 new jobs created in just a few months. PHLpreK providers reported having created 191 teaching positions; 147 of which are full time and 44 are part-time. In addition, pre-K providers have hired 60 support and administrative staff members. The average wage reported is $14.72 per hour. And a dozen more centers are still hiring!

-

Supporting neighborhood economies. The economic benefits also extend beyond direct jobs. Nearly half of all providers have also made facility enhancements that required hiring professional contractors, and we know that parents have also been able to return to the workforce as a result of this initiative. In fact, 3 centers have hired formerly unemployed PHLpreK parents! Additionally, studies show that pre-K providers and staff tend to spend their earnings locally, so we know the effects of these positions will continue to be felt in our local economy.

-

Funded eleven community schools, serving 6,150 students and their families, 75% of whom are living at or below the poverty line. Community schools transform struggling public schools into neighborhood hubs with services that address challenges students and their families face, like poverty, hunger, trauma, that keep them from succeeding academically. Already, community school coordinators have connected students with job opportunities, made it safer for students to get to and from schools, created programs to offer healthy food and help families facing hunger, offered parenting classes to teens raising children, raised money for library renovations, launched a community mural project, founded a male mentoring program, expanded afterschool activities, established clothing banks and increased access to winter clothes.

-

Launching Rebuild. The City’s $500 million program to renovate parks, rec centers and libraries is finishing its planning stages and is expected to announce its first round of sites before the end of the year with several million dollars worth of project investments.